Unlock Your Educational Success with Level Beast Consulting

Achieve Your Educational Dreams with Level Beast! Expert guidance on college admissions, test prep, career counseling, and financial aid, tailored just for you. Unleash your potential today!

Risk Disclosure

Space is limited. While we get you set up, here are the next steps

& what you can expect:

Risk Disclosure Statement – Level Beast

Last Updated: October 13, 2025

This Risk Disclosure Statement ("Disclosure") applies to all users of Level Beast, LLC ("Level Beast," "we," "us," or "our") and its Website, Platform, dashboards, analytics tools, content, and subscription Services (collectively, the "Services").

By accessing or using Level Beast, you acknowledge, understand, and agree to all risks described herein. If you do not agree, you must immediately discontinue use of our Services.

This Disclosure is incorporated by reference into our Terms & Conditions and should be read in conjunction with our Privacy Policy.

1. Purpose & Scope of Services

1.1 Educational & Informational Purpose Only

Level Beast provides:

Market data analytics and visualizations

Gamma exposure (GEX) analysis and options flow data

Trade plans, levels, and technical analysis

Educational content, tutorials, and research materials

Dashboard tools and market structure insights

All Services are provided for informational and educational purposes only.

1.2 Not Financial Advice

Level Beast does NOT provide:

Investment advice or recommendations

Financial planning or portfolio management services

Tax, legal, or accounting advice

Personalized trading signals or buy/sell recommendations

Brokerage, execution, or trade facilitation services

Nothing on our Website or within our Services should be construed as:

A solicitation to buy or sell securities, options, futures, or other financial instruments

An endorsement or recommendation of any specific security, strategy, or trade

A guarantee or promise of trading profits or investment returns

Personalized financial advice tailored to your individual circumstances

1.3 Regulatory Status

Level Beast is NOT registered with:

The U.S. Securities and Exchange Commission (SEC) as an investment adviser

The Commodity Futures Trading Commission (CFTC) as a commodity trading advisor

The Financial Industry Regulatory Authority (FINRA) as a broker-dealer

The National Futures Association (NFA)

Any other U.S. or international regulatory body as a financial services provider

We are a data analytics and education platform, not a regulated financial services firm.

2. Substantial Risk of Trading Loss

2.1 High Risk of Capital Loss

Trading stocks, options, futures, and other derivatives carries substantial risk of financial loss.

Key risks include:

Total Loss of Capital: You may lose your entire investment, including principal

Losses Exceeding Investment: With leveraged products (futures, options, margin accounts), losses can exceed your initial capital

Rapid Losses: Market volatility can result in significant losses in minutes or hours

Margin Calls & Liquidations: Insufficient account equity may trigger forced liquidation of positions at unfavorable prices

2.2 Not Suitable for All Investors

Trading is not appropriate for individuals who:

Cannot afford to lose their invested capital

Lack sufficient trading knowledge, experience, or risk tolerance

Are using borrowed funds, retirement savings, or emergency funds

Have inadequate financial resources to withstand trading losses

You should only trade with risk capital — money you can afford to lose completely without affecting your financial well-being.

2.3 Specific Instrument Risks

Options Trading:

Options can expire worthless, resulting in 100% loss

Selling uncovered (naked) options exposes you to unlimited loss potential

Time decay (theta) erodes option value, especially near expiration

Implied volatility changes can significantly impact option prices

Futures Trading:

Futures contracts are highly leveraged instruments

Small price movements can result in large gains or losses

Futures positions may be liquidated without notice if margin requirements are not met

Limited risk exists only with defined-risk strategies (e.g., spreads with long options)

Equity Trading:

Stock prices can decline to zero

Market gaps (price jumps) can occur overnight or during trading halts

Stop-loss orders do not guarantee execution at your specified price

Low liquidity stocks may be difficult to exit at desired prices

Spreads & Complex Strategies:

Multi-leg strategies involve additional execution risk, slippage, and transaction costs

Early assignment risk on short options can result in unexpected positions

Spreads may widen during volatile markets, limiting exit opportunities

3. Leverage & Margin Risks

3.1 Leverage Magnifies Risk

Many trading instruments involve leverage, which amplifies both potential gains and losses.

Leverage Risks:

A small adverse price movement can result in substantial or total loss of your investment

You may be required to deposit additional margin funds on short notice

If you fail to meet a margin call, your broker may liquidate positions without your consent

Margin interest charges accumulate and reduce profitability

3.2 Margin Calls & Forced Liquidation

If your account equity falls below required margin levels:

Your broker may issue a margin call requiring immediate deposit of additional funds

Failure to meet a margin call can result in forced liquidation of positions at market prices (which may be unfavorable)

You remain liable for any resulting account deficit

Level Beast has no control over margin requirements, margin calls, or liquidation decisions made by your broker.

4. Market Volatility & Execution Risks

4.1 Market Volatility

Financial markets are subject to rapid and unpredictable price movements caused by:

Economic data releases (CPI, NFP, FOMC, GDP, etc.)

Geopolitical events (wars, elections, policy changes)

Corporate earnings announcements

Natural disasters or unexpected crises

Changes in market sentiment or "risk-on/risk-off" conditions

High volatility can result in:

Extreme price swings within short time periods

Widened bid-ask spreads and reduced liquidity

Slippage (execution at prices worse than expected)

Gaps (price jumps over levels without trading in between)

4.2 Execution & Slippage Risks

Your actual execution price may differ significantly from expected prices due to:

Slippage: Difference between intended price and actual fill price

Market orders: Execute at current market price, which may be unfavorable during volatility

Stop-loss orders: Do not guarantee execution at the stop price; may fill at worse prices during gaps or fast markets

Limit orders: May not execute if price does not reach your limit

Liquidity constraints: Thinly traded securities may have wide bid-ask spreads

Level Beast does not execute trades and has no control over order execution, slippage, or fill prices.

5. Data Accuracy & Limitations

5.1 Data Sources & Interpretation

Level Beast aggregates and interprets market data from third-party sources, including:

Options chains from exchanges and data providers

Gamma exposure (GEX) calculations based on open interest and Greeks

Market structure analytics (support/resistance, flips, magnet levels)

News feeds, economic calendars, and sentiment data

We make reasonable efforts to ensure data accuracy, but:

Data may contain errors, omissions, delays, or inaccuracies

Third-party data providers may experience outages, errors, or disruptions

Our interpretations and analytics are based on mathematical models and assumptions that may not accurately reflect market dynamics

Real-time data may be delayed or subject to exchange reporting lags

5.2 No Guarantee of Accuracy

Level Beast does NOT warrant or guarantee:

The accuracy, completeness, or timeliness of any data

That data or analytics are free from errors or omissions

That our gamma exposure calculations or trade plans will accurately predict market movements

That historical patterns or backtested strategies will repeat in the future

5.3 User Responsibility to Verify

You are solely responsible for:

Independently verifying all data, analytics, and information before making trading decisions

Cross-referencing Level Beast data with other sources

Understanding the limitations and assumptions underlying our analytics

Conducting your own due diligence and research

Do not rely solely on Level Beast data as the basis for entering or exiting trades.

6. No Guarantee of Profitability

6.1 Past Performance Is Not Indicative

Past performance, historical data, and backtested results do NOT guarantee future results.

Previous winning trades or strategies may fail in different market conditions

Historical patterns (support/resistance, gamma flips, magnet levels) may not repeat

Market structure and dynamics change over time

What worked in the past may not work in the future

6.2 No Profit Guarantees

Level Beast makes NO guarantees, representations, or warranties regarding:

Profitability or positive returns from using our Services

Success rates of trade plans, levels, or strategies

Consistency of results over time

Your ability to generate income or replace employment through trading

Most traders lose money. Trading profitably requires skill, discipline, experience, and capital — none of which Level Beast can provide or guarantee.

6.3 Hypothetical & Backtested Results

Any hypothetical or backtested performance results presented by Level Beast:

Do not represent actual trading

Are based on assumptions and hindsight that may not reflect real-world conditions

Do not account for slippage, commissions, fees, or execution challenges

May overstate potential returns and understate risks

Hypothetical results should be viewed with skepticism and not relied upon as indicative of future performance.

7. Psychological & Behavioral Risks

7.1 Emotional Trading

Trading involves significant psychological challenges, including:

Fear and greed: Emotional reactions can lead to impulsive, irrational decisions

Overconfidence: Early success may lead to excessive risk-taking

Revenge trading: Attempting to recover losses through increasingly risky trades

FOMO (fear of missing out): Chasing trades without proper analysis

Panic selling: Exiting positions prematurely during volatility

Emotional decision-making is a leading cause of trading losses.

7.2 Discipline & Risk Management

Successful trading requires:

Strict adherence to a trading plan and risk management rules

Ability to accept losses without emotional reaction

Patience to wait for high-probability setups

Discipline to avoid overtrading or revenge trading

Level Beast provides data and analytics but cannot instill discipline, patience, or emotional control.

8. Third-Party Risks

8.1 Broker & Platform Risks

Level Beast does not provide brokerage services. You are responsible for:

Selecting a reputable, financially sound broker

Understanding your broker's terms, fees, margin requirements, and policies

Ensuring your broker is properly regulated and insured (e.g., SIPC coverage)

Risks associated with brokers include:

Broker insolvency or bankruptcy

Platform outages, technical failures, or data errors

Order execution delays or failures

Unauthorized account access or fraud

Level Beast is not responsible for any issues, losses, or damages arising from your broker or trading platform.

8.2 Third-Party Data Providers

Level Beast relies on third-party data providers. We are not liable for:

Data provider outages, errors, or inaccuracies

Delays or interruptions in data feeds

Incorrect or incomplete data from third parties

9. Regulatory & Legal Risks

9.1 Changing Regulations

Financial markets are subject to extensive regulation that can change at any time. Regulatory changes may:

Restrict certain trading strategies or instruments

Increase margin requirements or transaction costs

Limit access to markets or products

Impose new reporting or tax obligations

You are solely responsible for understanding and complying with all applicable laws and regulations.

9.2 Tax Implications

Trading activity may have significant tax consequences, including:

Short-term vs. long-term capital gains treatment

Wash sale rules

Mark-to-market elections for traders

Self-employment tax for professional traders

Level Beast does not provide tax advice. Consult a qualified tax professional regarding your specific situation.

10. User Responsibility & Acknowledgment

10.1 Your Sole Responsibility

By using Level Beast, you acknowledge and agree that:

You are solely responsible for all investment research, analysis, strategies, and trading decisions

You assume all financial risk associated with your trading activity

Level Beast provides data and education only — not personalized advice or recommendations

You will independently verify all information before acting on it

You will not rely solely on Level Beast data as the basis for trading decisions

10.2 Consultation with Professionals

Before engaging in trading, you should:

Consult with a licensed financial advisor to assess your suitability for trading

Seek legal advice regarding regulatory compliance and contractual obligations

Consult a tax professional regarding tax implications of trading activity

Ensure you have adequate financial resources, risk tolerance, and knowledge

10.3 Capital Risk Acknowledgment

You acknowledge that:

You will only trade with risk capital — money you can afford to lose completely

You will not trade with borrowed funds, retirement savings, emergency funds, or money needed for living expenses

Trading losses could materially impact your financial condition and quality of life

You accept full responsibility for any losses incurred

11. Disclaimer of Warranties

11.1 "AS IS" Disclaimer

The Services are provided "AS IS" and "AS AVAILABLE" without warranties of any kind, express or implied.

Level Beast expressly disclaims all warranties, including but not limited to:

Accuracy, completeness, or timeliness of data or content

Merchantability or fitness for a particular purpose

Non-infringement of third-party rights

Profitability or success of strategies, trade plans, or analytics

Continuous, uninterrupted, or error-free access to Services

Security or freedom from viruses, bugs, or harmful code

11.2 No Guarantee of Results

Level Beast makes NO guarantees or promises regarding:

The accuracy or reliability of gamma exposure calculations, trade levels, or market structure analytics

The performance or profitability of any trade plan, strategy, or approach

Your ability to generate income, profits, or positive returns

The suitability of our Services for your specific needs or financial situation

12. Limitation of Liability

12.1 Maximum Liability Cap

To the fullest extent permitted by law:

Level Beast, its affiliates, parent companies, subsidiaries, officers, directors, employees, contractors, agents, licensors, and service providers shall NOT be liable for any:

Trading losses or investment losses of any kind

Account blow-ups, margin calls, or forced liquidations

Lost profits, lost revenue, or lost opportunities

Direct, indirect, incidental, consequential, punitive, or special damages

Business interruption or loss of data

Damages arising from reliance on Level Beast data, analytics, trade plans, or content

Damages arising from data errors, omissions, delays, or inaccuracies

Damages arising from third-party service failures (brokers, data providers, etc.)

12.2 Total Liability Cap

Level Beast's total aggregate liability to you for any and all claims arising out of or relating to your use of the Services shall not exceed the total amount paid by you to Level Beast in the twelve (12) months prior to the claim.

12.3 Essential Basis of Agreement

You acknowledge that Level Beast has set its prices and entered into this Agreement in reliance upon these limitations of liability and disclaimers, and that they form an essential basis of the bargain between the parties.

13. Indemnification

You agree to indemnify, defend, and hold harmless Level Beast, its affiliates, officers, directors, employees, contractors, agents, and service providers from any and all:

Claims, demands, actions, or proceedings

Liabilities, damages, losses, costs, and expenses (including reasonable attorneys' fees)

arising out of or related to:

Your use of the Services

Your trading activity and decisions

Your reliance on Level Beast data, analytics, or content

Any trading losses or damages you incur

Your violation of this Disclosure or the Terms & Conditions

Your violation of any applicable law or regulation

14. Acceptance of Risk

By continuing to use Level Beast, you expressly acknowledge, understand, and agree that:

✅ You have read, understood, and accept all risks described in this Disclosure

✅ You understand that trading involves substantial risk of loss, including the risk of losing your entire investment

✅ You recognize that Level Beast provides data and education only — not financial advice, trading signals, or profit guarantees

✅ You are solely responsible for your own trading decisions and their consequences

✅ You will independently verify all data and consult with licensed professionals before making trading or investment decisions

✅ You agree to hold Level Beast harmless for any losses, damages, or adverse outcomes arising from your trading activity

✅ You will only trade with risk capital you can afford to lose

✅ You have adequate financial resources, knowledge, and risk tolerance to engage in trading

If you do not accept these risks and responsibilities, you must immediately discontinue use of Level Beast.

15. Updates to This Disclosure

Level Beast reserves the right to revise or update this Risk Disclosure Statement at any time, in its sole discretion. Changes take effect upon posting to the Website. Continued use of the Services after updates constitutes acceptance of the revised Disclosure.

You are encouraged to review this Disclosure periodically.

16. Contact Information

If you have questions about this Risk Disclosure Statement, please contact us:

📧 Email: [email protected]

📬 Mailing Address:

Level Beast, LLC

9436 W. Lake Mead Blvd

Suite 5 PMB 1212

Las Vegas, NV 89134

United States

⚠️ CRITICAL REMINDERS

Trading Involves Real Financial Risk

You can lose your entire investment

Losses can exceed your initial capital with leveraged products

Most traders lose money

Past performance does not guarantee future results

Level Beast Is NOT:

A financial advisor or investment adviser

A broker-dealer or trading platform

A signal service or trade execution system

A guarantee of trading profits

You Should:

Only trade with risk capital you can afford to lose

Independently verify all information

Consult licensed professionals (financial advisors, CPAs, attorneys)

Understand that you trade at your own risk

Accept full responsibility for your trading decisions and outcomes

Use Level Beast Responsibly:

For research, education, and informational purposes only

As one of many tools in your trading toolkit

With realistic expectations and proper risk management

While exercising independent judgment and due diligence

By clicking "I Agree," creating an account, or using the Services, you acknowledge that you have read, understood, and agree to be bound by this Risk Disclosure Statement.

END OF RISK DISCLOSURE STATEMENT

1. Watch the welcome video

2. Watch the trade recap video

3. Request access to our private community

4. Check out training on the Training and FAQ page

5. Make sure you're signed up for the monthly levels and gamma report.

Here is a trade breakdown video to get started now!

Check out our Training & FAQ page for more videos,

to understand our system and get a head start before you get access!

You’ll receive the Monthly Gamma Report within minutes

Private Community Access

The Numbers!

What Traders Are Saying About Level Beast...

GET ON THE LIST!

Get Notified When The Full Level Beast App Goes Live

Personal Account or Funded Account, You Need To See This!

🌐 No more “guess the breakout” trades — we show the wall before it hits you

☑️Powered by the levels that institutions, market makers, and dealers actually use

🌐Coming Soon: Custom levels for options contracts — so you know where to buy with max edge

☑️ Coming Soon: Confluence-based alerts: not just where, but why price reacts

All The Tools You Need To Build A Successful

Trading Day

☑️ See gamma levels, volume shelves, and liquidity traps — all in one view

🌐Predict SPX, ES, & SPY reversals before they trigger. (More coming soon) i.e. NQ, NDX, QQQ, TSLA, MAG 7, etc...

☑️ Daily uploads — tested by real traders in real trades

🌐Built-in education so you don’t just follow levels — you understand them!

⚠️ Only 178 more traders will be accepted into early access

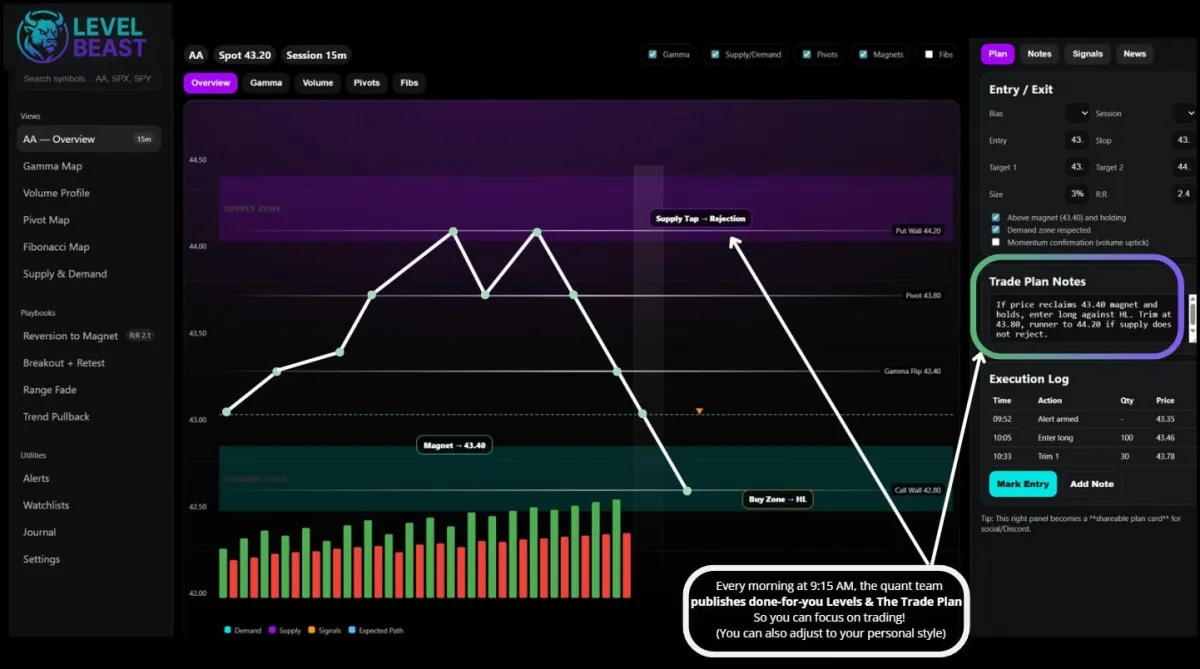

Daily Trade Plan

Your Pre-Market Edge — Know the Move Before It Happens

Every morning before the bell, we deliver a fully loaded trade plan — so you’re not guessing, reacting, or chasing. Built using our proprietary gamma, volume, and dealer flow models, this plan shows you where the market is likely to break out, reverse, or chop.

This isn't opinion, IT'S INCLUDED — it's data-backed execution at its finest

Trader Developed Levels

Real Analysts. Real Eyes. Real Accuracy

Most platforms give you raw data.

Level Beast gives you refined insight.

Every level — from gamma flips to magnets — is first calculated by our team…

Then it's reviewed, confirmed & adjusted by our pro traders and analysts before it's posted.

Why? Because the market isn't just math — it's volume, geopolitics, structure, nuance, news, earnings impact, order flow, bond markets, & much, much, more.

This final layer of human expertise is what makes our platform different.

You’re not trading off stale auto-zones or incomplete scripts.

You’re trading off the same process a professional desk would use — with both machine precision and trader judgment behind every level.

What It Fixes:

🚫 Distrust in AI-only levels

🧠 Confusion over which levels matter

☑️ Saves you 2+ hours of daily research

Magnet Levels

Wall Street’s Secret GPS — Now in Your Hands

Most traders chase breakouts. You won’t need to.

Our proprietary Magnet Levels are precision-calculated zones where price is statistically pulled like gravity. Each magnet is created using a fusion of:

☑️ Institutional Gamma Exposure

🌐 Volume Profile Density

🧠 Human-verified Price Levels

🌐 Custom Quant + Algorithmic Models

They’re not support/resistance — they’re where Wall Street is actually placing size and where dealer order flow is most active. When price enters a magnet, expect reaction. When price escapes one, expect momentum.

Trade them right, and you’re front-running the institutions — not following them. (SEE VIDEO)

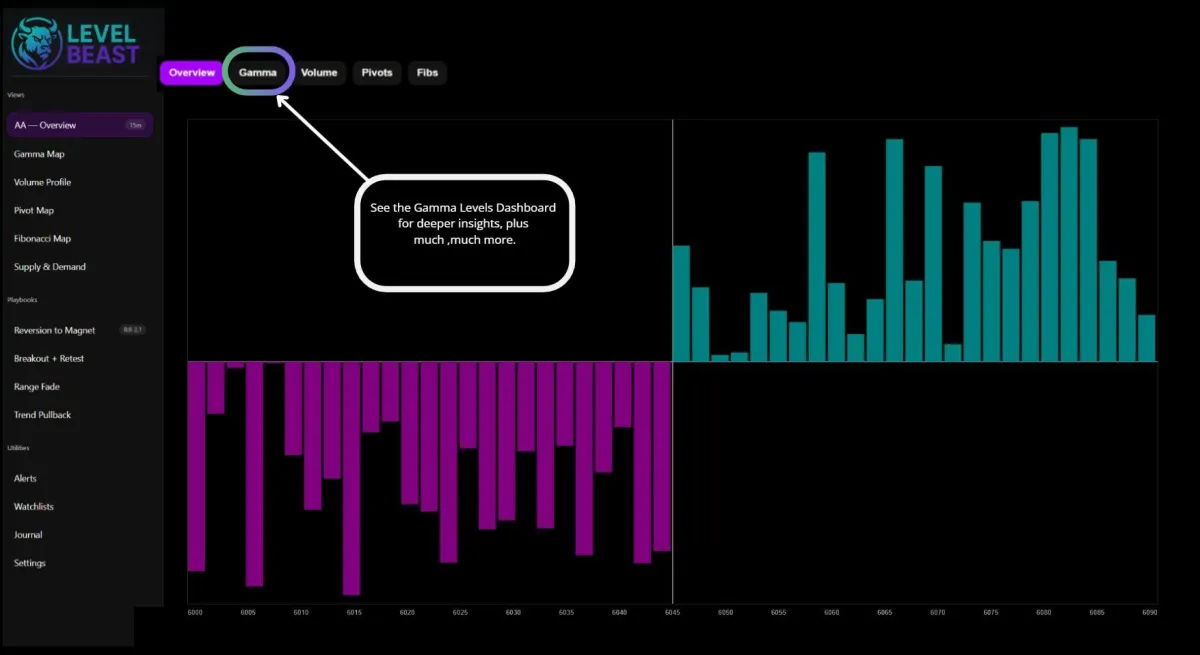

Gamma Dashboard

Deep Analytics for the Serious Trader — So You Don’t Get Trapped

Want to understand the why behind every move? The Gamma Dashboard gives you a front-row seat to the forces that actually move the market — dealer hedging behavior, gamma exposure shifts, and real reversal pressure zones.

Whether you're trading ES, SPX, SPY, or NDX, NQ or others, this tool shows you what most traders never see... and what institutions quietly use to manage billions.

Our Mission:

To make institutional-level trading tools accessible to every serious retail trader — without the Bloomberg price tag.

For years, we’ve used our private analytics platform to uncover high-probability trades using data mining, dealer flow, and deep market structure. Now we’re putting that power in your hands.

Level Beast is the first all-in-one analytics platform with done-for-you trade plans, precision levels, and real-time edge — so you can stop guessing and start trading like a pro. We will continue to grow and add value to level the playing field. Grow your skills with Level Beast!

_

Quant Team

Co-Founders of Level Beast

Subscribe today

Get our Monthly

Levels& Gamma Report

✔️ Know Where the Market is Likely to Reverse or Stall

✔️ See Magnet Price Levels That Pull Price Like Gravity

✔️ Know Dealer Flow & Sentiment for Major Tickers

✔️ See Timing Windows for Explosive Moves